Found inside Page 44The amount given as due on Current Account and Deposit Balances means that at a certain time on a certain day all the amounts found due by the Bank to its thousands of customers. The amount needs to be paid back in 15 days.

Trading Profit And Loss Account Double Entry Bookkeeping

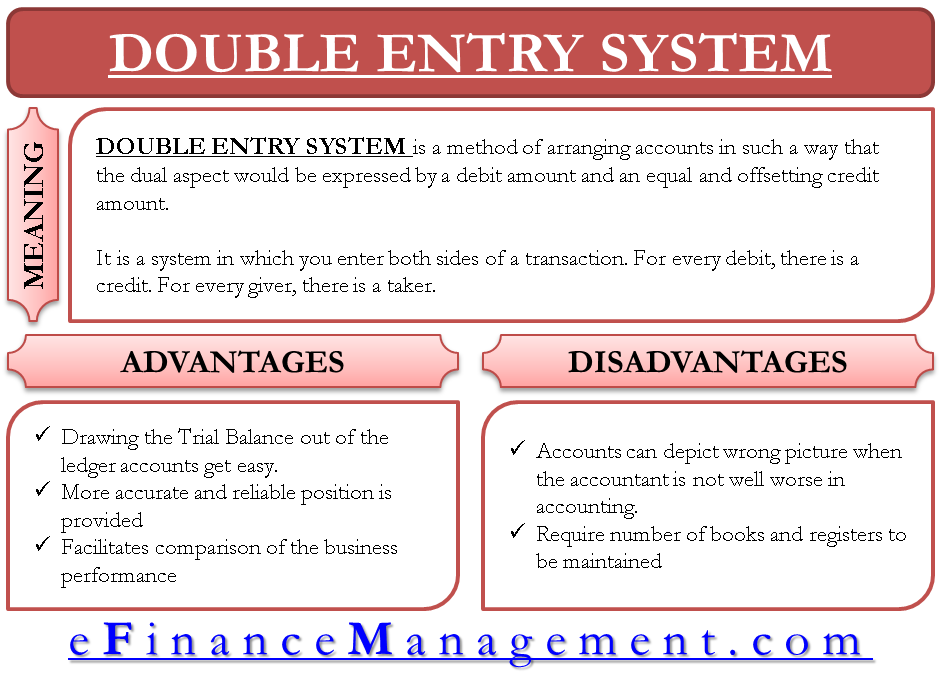

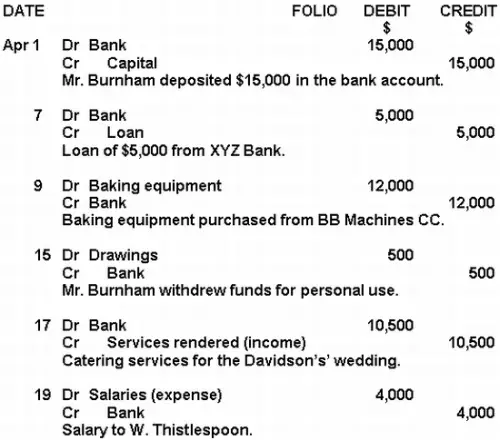

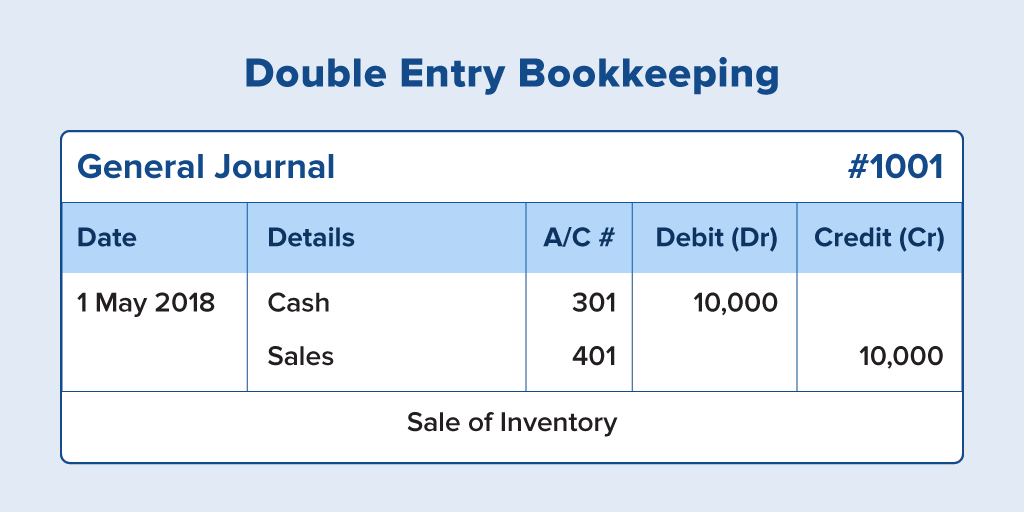

Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts.

. The amount that is due from customers is also referred to as Accounts Receivable. Double Entry for Directors Loans. If the loan was made to an unquoted trading company the individual will crystalise a capital loss equal to the amount of the loan written off.

A contra entry journal is used to make the adjustment. Credit that is due from customers is considered to be a current asset. Cash in cash out.

If you take out a 100000 loan it shifts to 600000 100000 500000. You must keep a record of any money you borrow from or pay into the Company and this record is usually known as a directors loan account. The director may loan the company 1000 to pay a supplier or cover working capital requirements.

Supplier Expenses Credit. The purpose is to tally both the accounts and balance the credit and the debit side. This is because the company has already serviced this order in terms of processing the relevant goods and services.

The equation would look like 500000 0 500000. 45 be largely different 44 THOUGHTS ON DOUBLE ENTRY. Accounts Receivable Double Entry Bookkeeping Double Entry System Of Bookkeeping Or Double Entry Accounting Efm Introduction To Bookkeeping And Accounting 3 6 The.

A Directors Loan is when you take money from your business that isnt a salary dividend or expense repayment and youve taken more than youve put in. The DLA is a combination of cash in money owed to and cash out money owed from the director. The director has been returned 79K already.

For example suppose a business has an amount of 1000 owed by a customer for services provided on account but also has an amount of 200 due to a supplier in this case the customers business for goods it has purchased. Overdrawn directors loan accounts is effectively an interest-free loan to the director and can have quite complex tax implications. The amount due from the customer has been posted to the accounts.

Companies develop a chart of accounts as the. AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment. This high-level equation is a summary of all the accounts that a double entry system uses.

The repayments I am recording as obviously the one credit the sum of the two debits. Director has made paymentsettlement to Supplier using his own personal bank account. Overdrawn DLA at Year End.

If an individual makes a loan to a company and this is subsequently written-off the company will have a non-trading loan relationship credit equal to the amount written off. He may also pay for several items of stationery and postage on behalf of the company using his own cash. Pay an employee 5000 and you end up with 595000 100000 495000.

Corporation Tax S455 25 of the balance of any overdrawn directors loan account still outstanding 9 months and 1 day after the end of the accounting period. 1100628-TIncorporated in Malaysia 14 NOTES TO THE FINANCIAL. They put the money in the bank account.

Individual Loans written-off. You pay a credit card statement in the amount of 6000 and all of the purchases are for expenses. Amounts due to the director from the.

The entry is a total of 6000 debited to several expense accounts and 6000. OK so the directors of a company have taken out a loan themselves that is used only for business purposes as they were unable to raise the money any other way. CASA FOREST BIO WOOD MANUFACTURING SDN.

For an example you borrowed 30000 from your company in June. Amount due to Director But im not sure how to do it in QB. DEFERRED TAXATION The annexed notes form an integral part of these financial statements.

Company 1 purchases goods from Company 2 on account credit. Company 2 will record the sale as due from account and Company 1 will record the purchase in the due to account as they have yet to pay Company 2. A director lent 100K into a firm but the firm is always in loss and can only reply 79K.

This is the representation of the debtors that the company has at a given. - Line 2 chose Opening balance equity account and entered the loan amount in Credits. It seems an income will occur.

The formatting makes it difficult to read but I think it shows break even reserves 87 at 300908. Under the accrual method of accounting the above transaction will be. If to credit income and the company is profitable this year any corporatoin tax to pay.

A double entry accounting system refers to the bookkeeping method where two entries are made simultaneously into two different accounts indicating a firms cash inflow and outflow. It is the basis for modern bookkeeping. I am confused that what double entry the system has done.

Add totals due to director from the company 40000 Salary Dividends voted Expenses paid out Minus totals taken out by paid to director 65000. Accounting entry should be. For the firm what is the double entry for writting off the 21K director loan.

This accounting system helps organizations assess their overall performance.

Loan Repayment Principal And Interest Double Entry Bookkeeping

Received Cash On Account Journal Entry Double Entry Bookkeeping

Double Entry Accounting Money Zine Com

Double Entry System Of Bookkeeping Or Double Entry Accounting Efm

The Basic Accounting Journal Entries

What Is Double Entry Bookkeeping A Simple Guide For Small Businesses

Why Choose Double Entry Accounting Over Single Entry Examples

General Ledger Accounting Double Entry Bookkeeping

Double Entry Bookkeeping System Accounting For Managers

Difference Between Double Entry System And Single Entry System Difference Between

Journal Entries For Transfers And Reclassifications Oracle Assets Help

Double Entry Bookkeeping System Accounting For Managers

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping

General Journal In Accounting Double Entry Bookkeeping

Double Entry Bookkeeping In 7 Steps

Journal Entries For Transfers And Reclassifications Oracle Assets Help

The Accounting Equation And The Principles Of Double Entry Bookkeeping

Double Entry Accounting Type Of Accounting Zoho Books

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions